SIPRI: China’s Corruption Purge Disrupts Weapons Programs

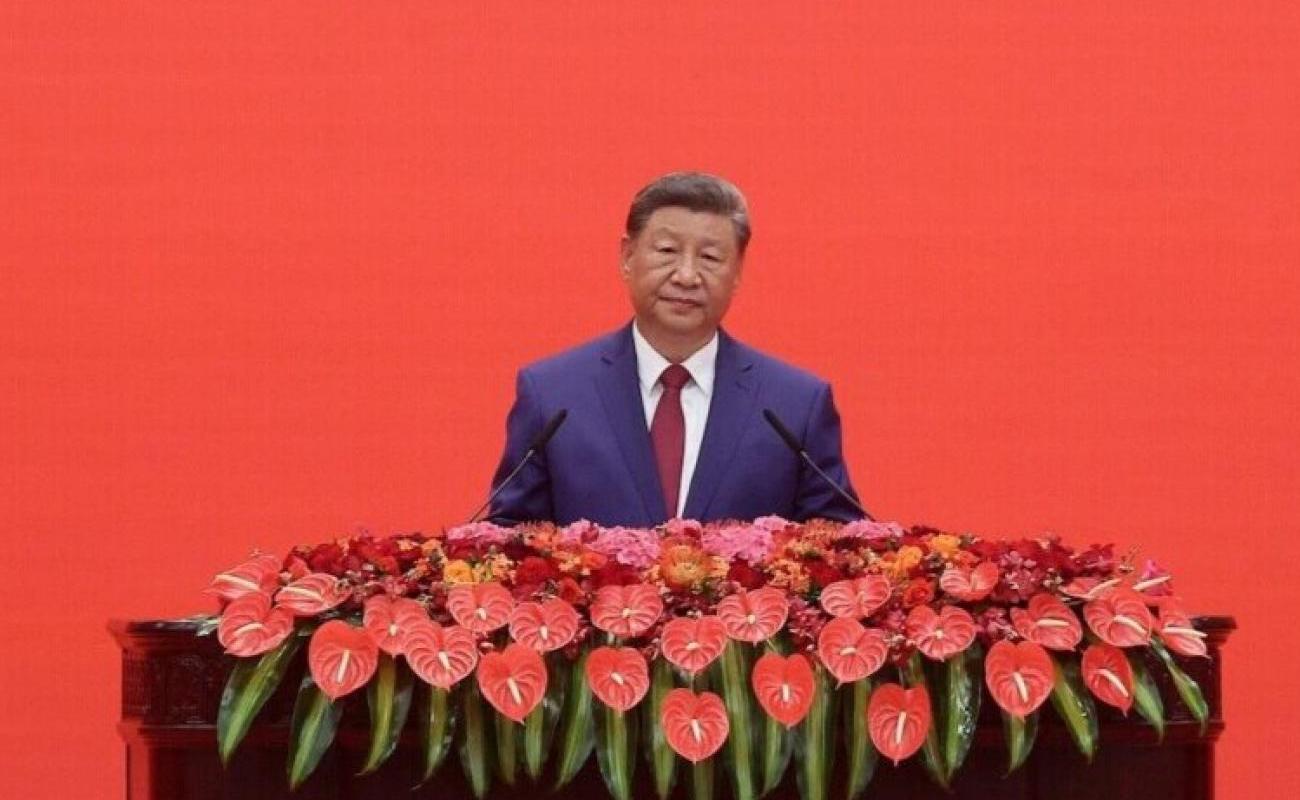

China’s powerful state-owned defense companies recorded a rare decline in revenues last year as President Xi Jinping’s sweeping anti-corruption campaign disrupted procurement, stalled weapons projects and injected fresh uncertainty into the country’s military modernization drive, according to a new report by the Stockholm International Peace Research Institute (SIPRI).

The findings reveal a sharp contrast between China and the rest of the global arms industry, which saw record-breaking growth amid intensified geopolitical tensions and ongoing wars in Ukraine and Gaza. SIPRI said revenues for the world’s 100 largest defense firms rose by 5.9% to an unprecedented $679 billion in 2024, while China became the only major producer showing a downturn.

Corruption crackdown freezes contracts

SIPRI researchers said revenues for China’s top defense companies dropped 10%, citing a wave of corruption allegations that triggered internal audits, leadership purges and procurement delays across multiple military branches.

“A host of corruption allegations in Chinese arms procurement led to major arms contracts being postponed or cancelled in 2024,” said Nan Tian, director of SIPRI’s Military Expenditure and Arms Production Program. “This deepens uncertainty around the status of China’s military modernization efforts and when new capabilities will materialize.”

China’s anti-graft campaign, launched by Xi shortly after taking power in 2012, has repeatedly struck the military. But the crackdown escalated dramatically in 2023 when the elite PLA Rocket Force, which oversees China’s expanding arsenal of ballistic and hypersonic missiles, became the focus.

In October 2025, eight senior generals — including former vice chairman of the Central Military Commission He Weidong, China’s second-highest-ranking officer — were expelled from the Communist Party on corruption charges. Analysts say the scale of the purge has few precedents in recent military history.

Asia-Oceania bucks global military boom

China’s downturn occurred despite Beijing’s defense budget rising annually for 30 consecutive years, driven by strategic competition with the United States, tensions over Taiwan and territorial disputes in the South China Sea.

SIPRI’s data shows that while China’s revenues fell, other major producing nations posted significant growth, Japan: +40%, Germany: +36%, and United States: +3.8%.

The surge reflects surging global demand for advanced weapons, drones, missiles and ammunition as governments boost their military preparedness.

China’s decline, however, was severe enough to make Asia-Oceania the only region where top arms companies collectively saw revenues contract.

China’s biggest arms makers suffer steep losses

Several of China’s largest defense conglomerates were affected, Norinco, the leading land-systems developer, reported a dramatic 31% drop to $14 billion, SIPRI said — the steepest fall among China’s top firms. CASC, China’s major aerospace and missile manufacturer, also saw declines after corruption-related leadership reshuffles triggered internal reviews and project delays. AVIC, the state-owned aviation giant responsible for fighter jets and military aircraft, recorded slowed deliveries, particularly in the PLA Air Force.

None of the companies responded to requests for comment.

Diplomats in Beijing and foreign defense analysts say the effects of the purge are still unfolding. Some believe the crackdown could expose delays in next-generation missile systems, aircraft development, cyber warfare capabilities and satellite programs.

Modernzation targets at risk

China’s ambitious goal of upgrading key combat capabilities by the PLA’s 100th anniversary in 2027 may face delays, said SIPRI researcher Xiao Liang.

“The timeline of advanced systems for the Rocket Force could be exposed, along with aerospace and cyber programs,” Liang said.

The PLA has made large technological strides in recent years, deploying: The world’s largest navy and coast guard, a new generation of stealth aircraft and unmanned systems, expanding nuclear forces, multiple hypersonic missile platforms.

But SIPRI warns that corruption-related disruptions threaten to slow progress in the short term, particularly for strategically sensitive platforms.