Russia’s manufacturing sector in continued decline: Activity falls for the seventh consecutive month

Russia’s manufacturing sector continued to weaken at the end of 2025, with business activity contracting for the seventh month in a row, according to a survey published by S&P Global.

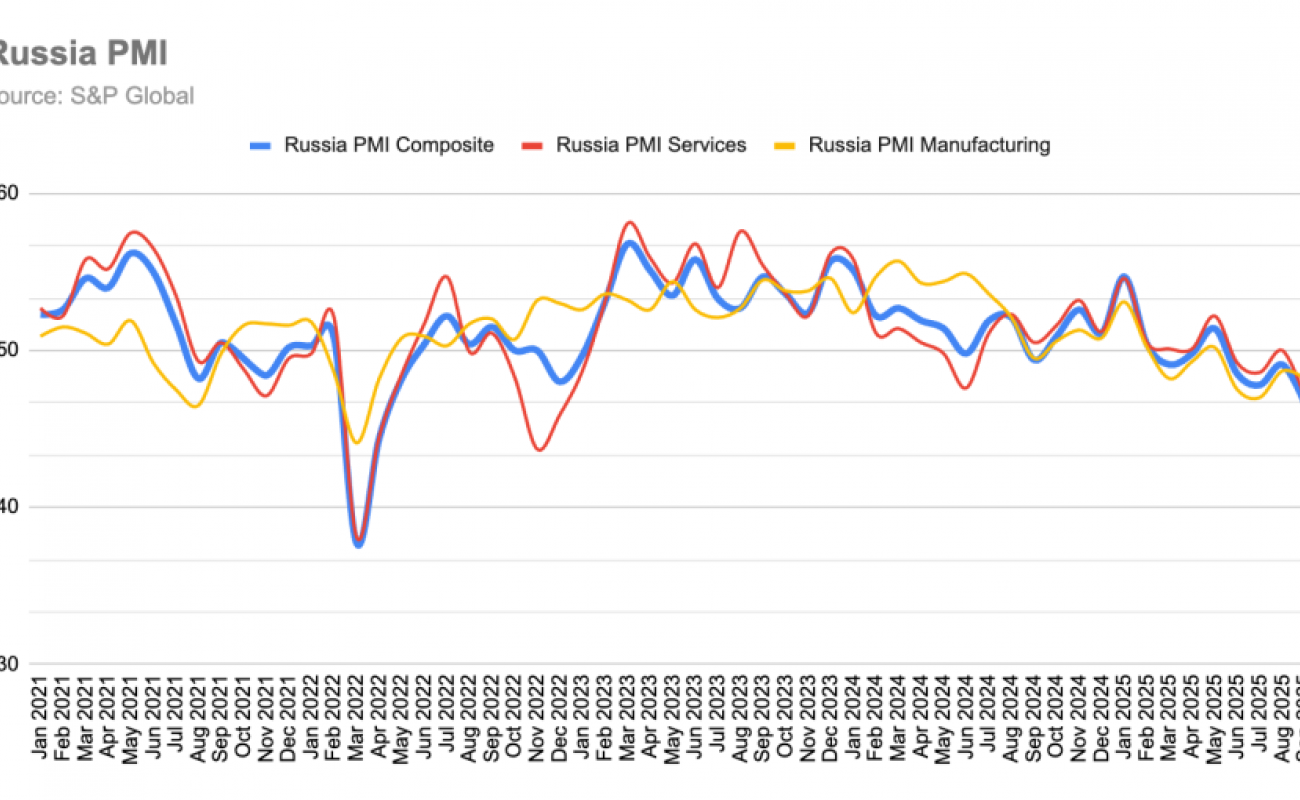

The Purchasing Managers’ Index (PMI) for Russian manufacturing fell to 48.1 points in December, down from 48.3 in November. A PMI reading below 50 indicates a contraction in activity, while a figure above that threshold signals expansion.

According to S&P Global, companies reported declines in both output and new orders, with production recording its steepest drop since March 2022. Survey respondents attributed the downturn to more cautious customers and a decline in consumers’ purchasing power.

Expectations for the year ahead fell to their lowest level since May 2022, prompting companies to cut back on hiring and purchasing activity amid a deteriorating economic outlook.

At the same time, input costs rose at their fastest pace since March, with firms passing on higher expenses to consumers through price increases.

Dmitry Belousov of the Center for Macroeconomic Analysis and Short-Term Forecasting (CMASF) said that company managers have not expressed such negative sentiment since the Covid-19 pandemic.

Official data on industrial output for December have not yet been released, but November figures showed a 1.5% month-on-month decline and a 0.7% year-on-year drop. According to CMASF, a brief uptick in October proved short-lived, while output between September and November grew by an average of just 0.2% per month.

Analysts note that recent fluctuations have been driven mainly by sectors linked to the defense industry, while civilian manufacturing has stagnated for four consecutive months. Russian President Vladimir Putin has also acknowledged the existence of “imbalances” in the economy, including declining output in certain industries.

Meanwhile, Vladimir Potanin, one of Russia’s wealthiest businessmen and a co-owner of Norilsk Nickel, described the current situation as a serious test of resilience for businesses and entire industries.

Experts at the Gaidar Institute point to steady growth in sectors such as pharmaceuticals, aviation, and transport equipment, in contrast to declines in machinery, automobile manufacturing, and construction materials. They expect this divergence to continue, with growth concentrated in sectors tied to state orders and import substitution, while consumer-oriented industries remain under pressure.

However, Russia’s Central Bank has played down the risk of a recession. Andrei Gangan, director of the Central Bank’s monetary policy department, said that despite a mixed picture across industries, the Russian economy as a whole continues to grow, albeit at a slower pace than in previous years.

Enterprise monitoring conducted by the Central Bank itself presents a more optimistic outlook, indicating continued growth in business activity, including in manufacturing.

Economists note that discrepancies with S&P Global’s findings may stem from differences in survey samples, as the S&P Global survey does not extensively cover enterprises linked to the defense industry./TheGeoPost.